Filing your taxes is an important part of managing your personal finances. However, when it comes to deciding whether to do it yourself or hire a professional, there are many factors to consider. Here are some of the pros and cons of each option:

Doing Your Own Taxes

Pros:

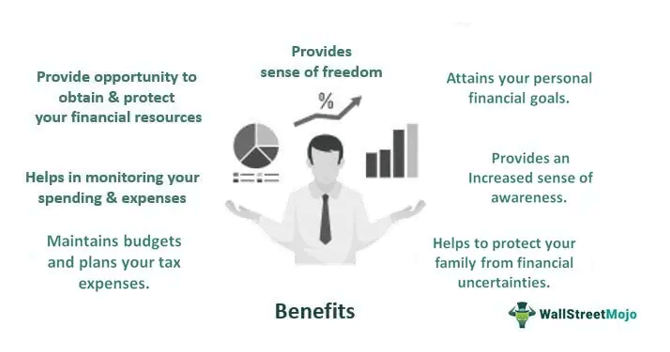

Save Money – One of the biggest advantages of doing your own taxes is that you can save money. You won’t have to pay for the services of a tax professional, which can be quite expensive.

Control – When you do your own taxes, you have complete control over the process. You can take your time and make sure everything is accurate.

Learn About Taxes – Doing your own taxes can be a great learning experience. You’ll gain a better understanding of the tax code and how it applies to your personal finances.

Cons:

Time-Consuming – Doing your own taxes can be a time-consuming process. You’ll need to gather all of your financial documents and navigate the complex tax code.

Stressful – Filing your taxes can be a stressful experience, especially if you’re not familiar with the process. Making mistakes can lead to penalties and fines.

Limited Expertise – Unless you’re a tax expert yourself, there may be deductions and credits that you’re not aware of. This can result in a higher tax bill or a smaller refund.

Hiring a Tax Professional

Pros:

Peace of Mind – One of the biggest advantages of hiring a tax professional is that it can provide peace of mind. You’ll have the reassurance that your taxes are being filed accurately and efficiently.

Save Time – Hiring a tax professional can save you a significant amount of time. They’ll handle all of the paperwork and ensure that everything is filed on time.

Expertise – A tax professional has the expertise and knowledge to help you maximize your deductions and credits. They can also provide valuable advice on tax planning.

Cons:

Expensive – Hiring a tax professional can be expensive. The cost can vary depending on the complexity of your taxes and the experience of the professional.

Lack of Control – When you hire a tax professional, you’re giving up control over the process. You’ll need to trust that they’re filing your taxes accurately and efficiently.

Dependence – When you hire a tax professional, you become dependent on them for your tax filings. If they make a mistake, you’ll be the one who suffers the consequences.

Conclusion

Deciding whether to do your own taxes or hire a professional is a personal decision that depends on your individual circumstances. If you have a simple tax situation and are comfortable navigating the tax code, doing your own taxes can save you money and provide a valuable learning experience. However, if you have a more complex tax situation or are not comfortable with the process, hiring a tax professional can provide peace of mind and ensure that your taxes are filed accurately and efficiently. Ultimately, the decision is up to you.