Retirement planning can be complex and challenging, especially for those who lack experience or knowledge of financial management. Working with a financial advisor can provide valuable guidance and expertise in managing your retirement personal finances. A financial advisor can help you develop a comprehensive retirement plan, identify investment opportunities, manage your portfolio, and provide ongoing advice and support. In this blog post, we’ll explore the benefits of working with a financial advisor, how to find the right advisor for your needs, and tips for building a successful working relationship with your advisor.

Benefits of Working with a Financial Advisor

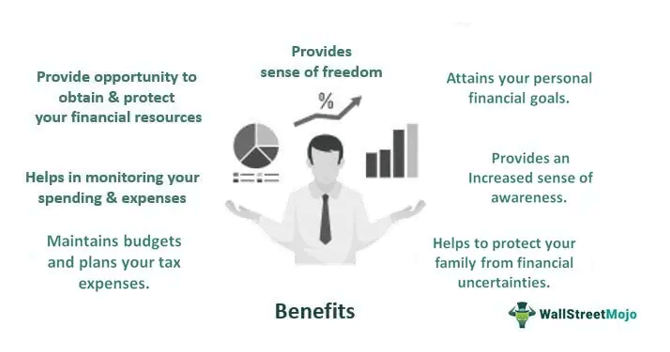

Here are some of the key benefits of working with a financial advisor:

Professional Expertise – Financial advisors have the knowledge and expertise to help you navigate complex financial issues and make informed decisions.

Customized Advice – A financial advisor can provide personalized advice and recommendations tailored to your unique financial situation and goals.

Investment Management – Financial advisors can help you manage your investments, identify opportunities, and monitor performance.

Financial Planning – A financial advisor can help you develop a comprehensive financial plan that includes retirement planning, estate planning, and tax planning.

Peace of Mind – Working with a financial advisor can provide peace of mind, knowing that you have a professional guiding your financial decisions and helping you achieve your goals.

How to Find the Right Financial Advisor

Finding the right financial advisor is critical to building a successful working relationship. Here are some tips for finding the right advisor for your needs:

Research and Compare – Do your research and compare different financial advisors based on their experience, expertise, and services offered.

Check Credentials – Look for financial advisors with industry certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA).

Check References – Ask for references and check online reviews to get a sense of a financial advisor’s track record and client satisfaction.

Consider Fees – Consider the fees charged by different financial advisors and ensure that they align with your budget and investment goals.

Tips for Building a Successful Working Relationship with Your Financial Advisor

Here are some tips for building a successful working relationship with your financial advisor:

Be Honest and Transparent – Be honest and transparent with your financial advisor about your goals, risk tolerance, and financial situation.

Communicate Regularly – Maintain open communication with your financial advisor and update them on any significant changes in your life or financial situation.

Follow Through – Follow through on your financial advisor’s recommendations and take an active role in managing your finances.

Reevaluate Regularly – Regularly reevaluate your financial advisor’s performance and ensure that they are meeting your expectations and goals.

In conclusion, working with a financial advisor can provide valuable guidance and expertise in managing your retirement personal finances. By finding the right advisor for your needs and building a successful working relationship, you can benefit from professional expertise, customized advice, investment management, financial planning, and peace of mind.