Planning for retirement is a lifelong endeavor, and choosing the right withdrawal strategy is a critical component of that plan. Whether you opt for the classic 4% rule, dynamic strategies, the bucket approach, or a combination of methods, the key is to align your strategy with your unique financial goals and circumstances. Remember that retirement planning is not a one-time task; it requires ongoing attention and adjustments. Seek guidance from financial advisors, stay informed about market trends, and be prepared to adapt your strategy as needed. By doing so, you can increase the likelihood that your retirement savings will provide the security and comfort you deserve in your golden years.

Tag: savings

Creating a Financial Plan for Your Life Goals

“Financial planning is not just about managing your money; it’s about creating a path towards the life you envision. In this blog post, we’ll break down the steps to create a solid financial plan that will help you achieve your life goals.”

The Cash Envelope Budgeting System Explained

Are you tired of overspending and struggling to manage your finances? The cash envelope budgeting system might be the solution you’ve been looking for. In this comprehensive guide, we’ll dive deep into the world of cash envelopes, explaining what they are, how they work, and why they can be a game-changer for your financial well-being. Join us on this journey to take control of your money and achieve your financial goals.

Savings vs. Investing: Building Wealth Strategies

Building wealth is a lifelong journey, and it requires strategic decision-making. In this blog post, we’ll delve into the age-old debate of savings vs. investing and explore how these two financial strategies can help you build a secure financial future.

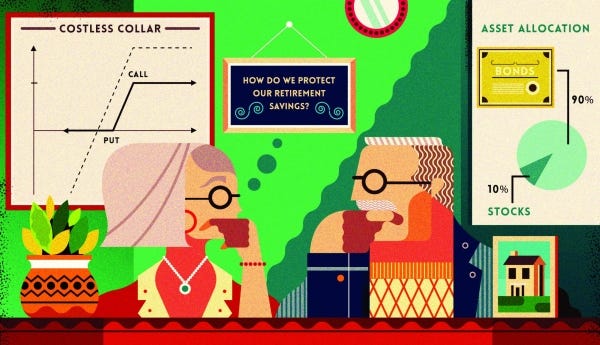

How to Protect Your Retirement Savings from Inflation and Market Volatility

Protecting your retirement savings from inflation and market volatility is crucial for ensuring financial security during your retirement years. In this blog post, we’ll explore some strategies for safeguarding your savings, including diversification, asset allocation, and inflation-indexed investments. We’ll also discuss the importance of working with a financial advisor to develop a personalized retirement plan that takes into account your individual goals and risk tolerance.

How to Save Money on Insurance and Maximize Your Personal Finances

Insurance is an important investment for protecting your personal finances, but it can also be expensive. In this blog post, we will discuss strategies for saving money on insurance and maximizing your financial well-being.