In the ever-evolving landscape of finance, managing risk is a paramount concern. Financial institutions and investment firms rely on sophisticated models to predict and mitigate risks associated with their investments. As the complexity of financial markets continues to grow, so too does the need for more powerful computational tools. Enter quantum computing, a game-changing technology that promises to revolutionize financial modeling and risk management.

Quantum Computing: A Brief Overview

Before delving into how quantum computing is reshaping financial modeling, let’s first understand the basics of this cutting-edge technology.

Traditional computers rely on bits, which can represent either a 0 or a 1. Quantum computers, on the other hand, use qubits, which can exist in multiple states simultaneously thanks to the principles of superposition and entanglement. This unique property allows quantum computers to process vast amounts of information exponentially faster than classical computers.

Quantum Computing and Financial Modeling

- Portfolio Optimization

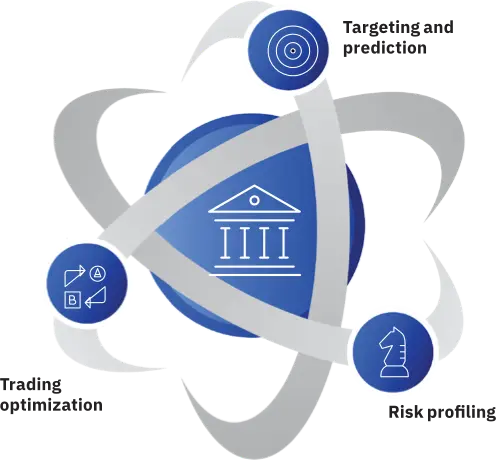

One of the most significant applications of quantum computing in finance is portfolio optimization. Traditional portfolio optimization models require solving complex mathematical equations, which can be extremely time-consuming, especially for large portfolios. Quantum computers can explore countless combinations of assets and their associated risks in a fraction of the time it would take classical computers. This speed and precision enable financial institutions to construct more efficient and diversified portfolios that maximize returns while minimizing risks. - Risk Assessment and Stress Testing

Risk assessment is a critical aspect of financial modeling. Quantum computing can enhance risk assessment processes by running simulations that consider a multitude of market scenarios simultaneously. This capability enables financial institutions to better understand and prepare for unexpected market events, such as economic crises or black swan events. Additionally, quantum computers can perform stress tests on portfolios in real-time, providing more accurate and up-to-date risk assessments. - Fraud Detection

Fraud detection is another area where quantum computing can make a significant impact. Fraudsters are continually developing more sophisticated tactics to evade detection, making it challenging for traditional fraud detection systems to keep up. Quantum computers can analyze vast datasets and detect anomalies in real-time, helping financial institutions identify and prevent fraudulent activities more effectively. - Algorithmic Trading

Algorithmic trading relies on complex mathematical models to make split-second trading decisions. Quantum computing can enhance these models by processing and analyzing market data at unprecedented speeds. This speed advantage can give financial firms a competitive edge in high-frequency trading, where every millisecond counts.

Challenges and Considerations

While quantum computing holds immense promise for the financial industry, several challenges and considerations must be addressed:

- Hardware Limitations

Quantum computers are still in their infancy, and building large-scale, stable quantum processors remains a formidable challenge. Financial institutions will need to work closely with quantum hardware providers to ensure the availability of suitable hardware for their specific needs. - Talent Shortage

Quantum computing expertise is currently in high demand, and there is a shortage of professionals with the necessary skills. Financial firms must invest in training and development to build a skilled quantum computing workforce. - Data Security

With the increased computational power of quantum computers, existing encryption methods may become vulnerable to attacks. Financial institutions must stay ahead of the curve by developing quantum-resistant encryption methods to protect sensitive financial data.

The Future of Financial Modeling

Quantum computing is poised to revolutionize financial modeling and risk management. As this technology continues to mature and become more accessible, financial institutions that embrace quantum computing will gain a competitive advantage in understanding and mitigating risks. However, it’s crucial to remember that quantum computing is not a silver bullet but rather a powerful tool that, when combined with traditional methods, can provide more accurate and timely insights into the complex world of finance.

In conclusion, the intersection of quantum computing and financial modeling opens up new possibilities for risk management in the financial industry. From portfolio optimization to fraud detection and algorithmic trading, quantum computing is reshaping the way financial institutions approach risk. While challenges exist, the potential benefits are too significant to ignore. As we look ahead, quantum computing promises to play a pivotal role in the future of finance, helping institutions navigate the ever-changing landscape of risk and opportunity.

In this blog post, we explored how quantum computing is transforming financial modeling and risk management. With its ability to process vast amounts of data at unprecedented speeds, quantum computing is becoming an indispensable tool for financial institutions seeking to optimize portfolios, assess and mitigate risks, detect fraud, and excel in algorithmic trading. However, challenges such as hardware limitations, a talent shortage, and data security concerns must be addressed to fully unlock the potential of quantum computing in finance.