In recent years, the world has witnessed a significant shift in the way we approach agriculture. With the growing population and the increasing demand for food, there is a pressing need for more sustainable and efficient agricultural practices. One solution that has gained significant traction is impact investing in smart agriculture. In this blog post, we will delve into the concept of impact investing in agriculture, explore the role of automation in funding and investment, and highlight the key trends driving this transformative approach to farming.

The Rise of Impact Investing

Impact investing, a form of socially responsible investing, has gained momentum across various industries, including agriculture. Traditionally, investors sought financial returns above all else, often overlooking the broader consequences of their investments. However, in the wake of pressing global challenges such as climate change, food security, and environmental degradation, a new breed of investors is emerging – those who prioritize both financial returns and positive societal and environmental impacts.

This shift towards impact investing in agriculture reflects a growing awareness of the need to address critical issues while generating financial returns. Smart agriculture, with its focus on sustainable and efficient farming practices, aligns perfectly with this evolving investment landscape.

Smart Agriculture: A Revolution in Farming

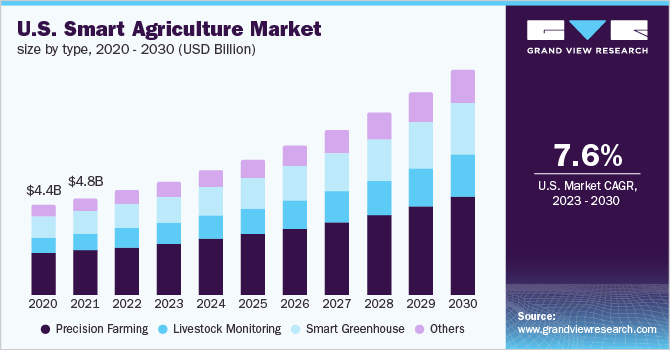

Smart agriculture, often referred to as precision agriculture, leverages technology and data-driven approaches to optimize various aspects of farming. From precision planting and automated irrigation to data-driven pest control and livestock monitoring, smart agriculture aims to increase yields, reduce resource consumption, and minimize environmental impact.

The adoption of automation and cutting-edge technologies in agriculture not only enhances productivity but also contributes to more sustainable farming practices. This transformation is precisely what makes smart agriculture an attractive investment opportunity for impact investors.

Automation in Agriculture Funding and Investment

One of the key drivers behind the rise of impact investing in smart agriculture is the integration of automation into the farming ecosystem. Automation technology has significantly reshaped the way farms operate, offering numerous benefits that appeal to both investors and farmers.

- Improved Efficiency

Automation streamlines various farming processes, reducing the need for manual labor and the associated costs. Automated machinery and robotic systems can perform tasks with precision and consistency, leading to increased overall efficiency. - Resource Conservation

Smart agriculture relies on data-driven decision-making to optimize resource use. By automating tasks such as irrigation, fertilization, and pest control, farmers can minimize waste and reduce the environmental footprint of their operations. This aligns with the sustainability goals of impact investors. - Predictive Analytics

Data collection and analysis are at the core of smart agriculture. Automated sensors and drones collect vast amounts of data on soil conditions, weather patterns, and crop health. This data allows farmers to make informed decisions and adjust their practices in real-time, ultimately increasing crop yields and minimizing risks. - Scalability

Automation technology is highly scalable, making it suitable for both small-scale and large-scale farming operations. This versatility makes smart agriculture an attractive investment option for a wide range of investors, from individuals to institutional funds.

Investment Opportunities in Smart Agriculture

Impact investors interested in smart agriculture have various avenues to explore. Here are some of the investment opportunities in this burgeoning sector:

- AgTech Startups

The AgTech (agricultural technology) sector has seen a surge in startups developing innovative solutions for farming. These startups often seek investment to scale their operations and bring their technologies to market. Impact investors can support these ventures and play a pivotal role in advancing sustainable agriculture. - Sustainable Agriculture Funds

Numerous funds focus specifically on sustainable agriculture and smart farming practices. These funds pool capital from investors and allocate it to projects and initiatives that promote sustainability in agriculture. Investing in such funds allows individuals and institutions to diversify their agricultural investments while driving positive impact. - Farm Automation Companies

Companies specializing in farm automation equipment and technology represent a direct investment opportunity in the automation-driven agriculture sector. These companies provide the essential tools and machinery needed for smart farming practices, making them a crucial part of the ecosystem. - Agricultural Data Analytics

The data generated by smart agriculture systems holds immense value. Investors can explore opportunities in companies that specialize in agricultural data analytics. These companies help farmers make data-driven decisions, optimizing their operations for maximum efficiency and sustainability.

Challenges and Considerations

While impact investing in smart agriculture offers promising opportunities, it’s essential to acknowledge the challenges and considerations that come with this approach:

- Technology Adoption

The adoption of automation and smart agriculture practices varies widely across regions and farming communities. Investors must assess the readiness of the target market for these technologies and consider factors like infrastructure and education. - Regulatory Landscape

Agriculture is subject to a complex web of regulations and policies that can vary significantly by region. Investors need to navigate this landscape to ensure compliance and mitigate potential risks. - Long-Term Commitment

Sustainable agriculture often requires long-term commitments from investors. Unlike traditional investments, the impact of smart agriculture initiatives may take time to materialize fully. - Risk Management

Investing in emerging technologies and startups carries inherent risks. Impact investors should diversify their portfolios and conduct thorough due diligence to manage these risks effectively.

Conclusion

Impact investing in smart agriculture represents a powerful opportunity to address some of the world’s most pressing challenges while generating financial returns. Automation plays a pivotal role in enabling sustainable farming practices and attracting investors to this transformative sector. As the demand for food continues to rise and environmental concerns intensify, impact investing in smart agriculture is poised to remain a growing trend that benefits both investors and the planet. By supporting innovative AgTech startups, sustainable agriculture funds, and automation companies, impact investors can drive positive change in the agriculture industry and contribute to a more sustainable and food-secure future.