A diversified investment portfolio is crucial for achieving long-term financial goals and reducing risk. By spreading your investments across different asset classes, you can balance risk and return and improve your chances of achieving your financial objectives. In this article, we will explore the key steps to building a diversified investment portfolio for your personal finances.

Step 1: Determine Your Risk Tolerance

Before you start building your investment portfolio, it’s important to understand your risk tolerance. Risk tolerance refers to the amount of risk you are willing and able to take on when investing. Your risk tolerance will depend on a variety of factors, including your age, financial goals, income, and expenses.

To determine your risk tolerance, consider factors such as your investment timeline, your financial goals, and your comfort level with risk. If you have a long investment timeline and are comfortable with risk, you may be able to tolerate a higher level of risk in your portfolio. If you have a short investment timeline or are uncomfortable with risk, you may want to focus on lower-risk investments.

Step 2: Choose Asset Classes

Once you have determined your risk tolerance, it’s time to choose asset classes for your investment portfolio. Asset classes are categories of investments that have similar characteristics and behave in similar ways. Common asset classes include stocks, bonds, real estate, and alternative investments.

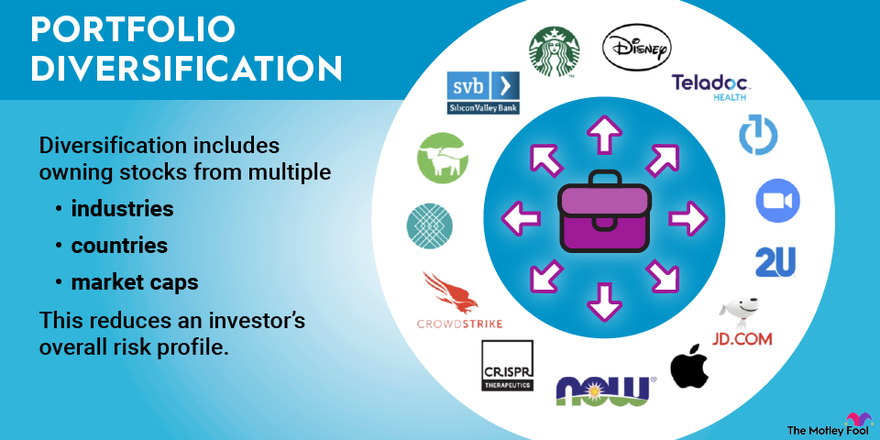

To build a diversified portfolio, you should consider investing in multiple asset classes. By investing in different types of assets, you can balance risk and return and reduce the impact of market fluctuations on your portfolio. Your allocation to each asset class will depend on your risk tolerance and financial goals.

Step 3: Select Individual Investments

Once you have chosen your asset classes, it’s time to select individual investments within each category. This can include individual stocks, bonds, mutual funds, or exchange-traded funds (ETFs).

When selecting individual investments, it’s important to consider factors such as historical performance, fees and expenses, and the overall risk and return characteristics of the investment. It’s also important to diversify within each asset class, by investing in multiple securities to reduce the impact of any one investment on your portfolio.

Step 4: Monitor and Adjust Your Portfolio

Finally, it’s important to monitor and adjust your investment portfolio over time. Market conditions and your personal financial situation can change, and your portfolio should be adjusted accordingly.

Regularly review your portfolio to ensure it remains aligned with your financial goals and risk tolerance. Consider rebalancing your portfolio periodically to ensure that your allocation to each asset class remains consistent with your risk tolerance and financial goals. This can help you stay on track to achieve your long-term financial objectives.

Conclusion

Building a diversified investment portfolio is essential for achieving long-term financial goals and reducing risk. By following these key steps, you can create an investment portfolio that aligns with your risk tolerance and financial objectives. Remember to regularly monitor and adjust your portfolio to ensure it remains aligned with your goals and risk tolerance. With a thoughtful investment strategy and careful management, you can build a successful investment portfolio and achieve financial security over time.