Introduction

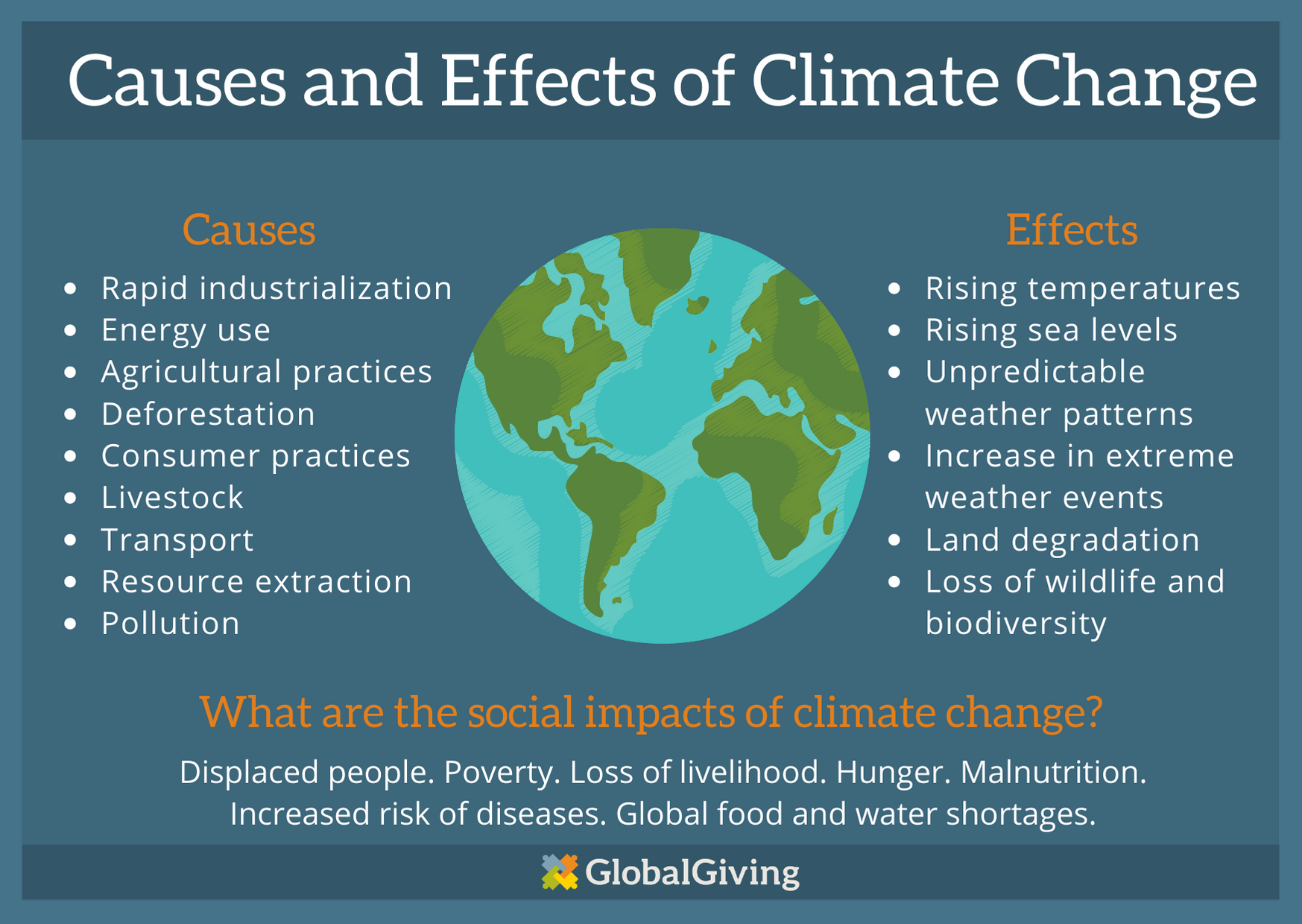

Climate change is undeniably one of the most pressing challenges facing humanity today. The rise in global temperatures, extreme weather events, and the loss of biodiversity are all stark reminders of the urgent need to combat this crisis. But addressing climate change requires a collective effort, and that includes rethinking the way we finance projects and investments.

Enter green finance – a powerful tool that has gained momentum in recent years. This blog delves into the world of green finance, exploring what it is, why it matters, and how it can help finance climate-positive projects that contribute to a greener and more sustainable future.

What is Green Finance?

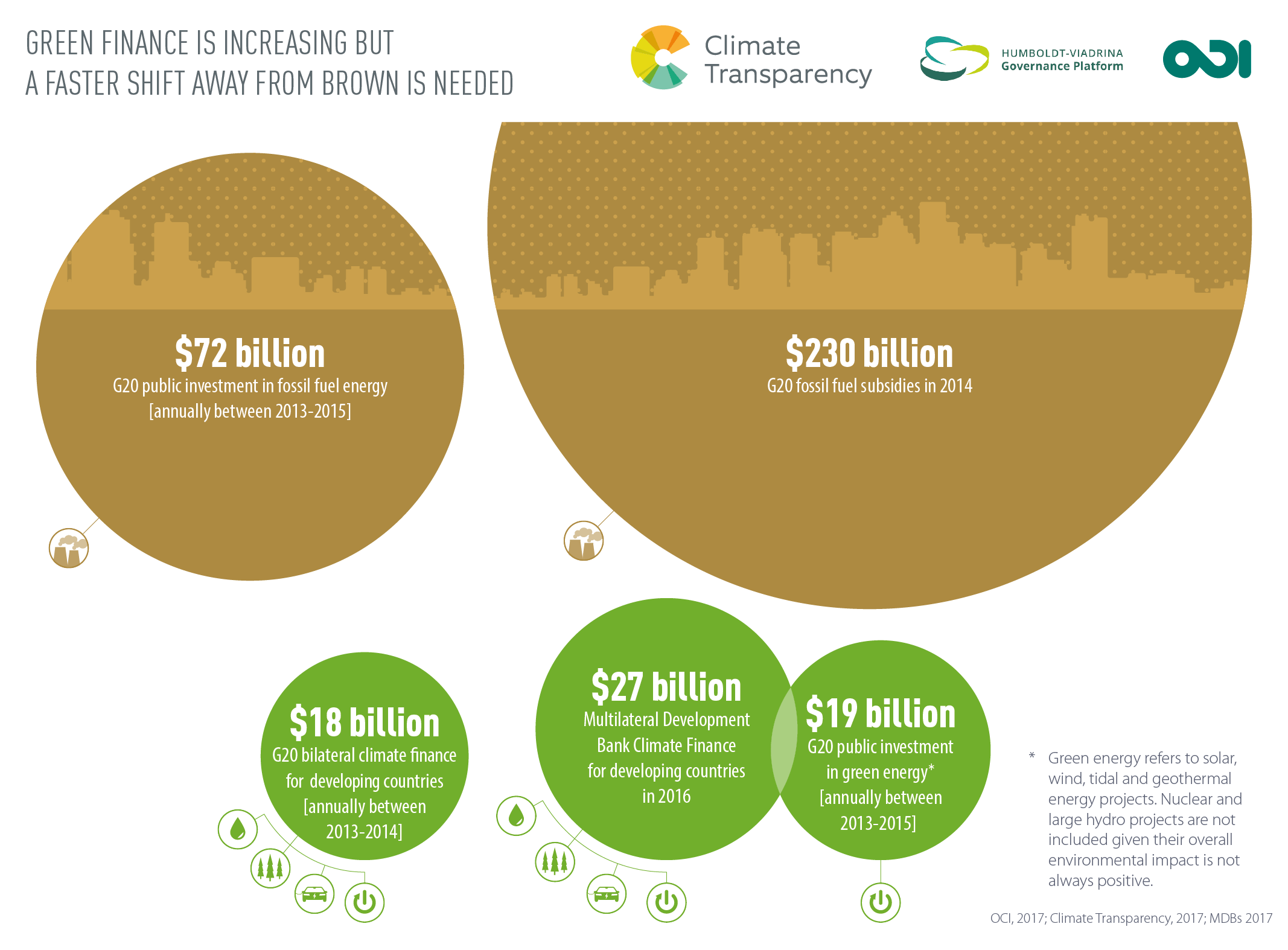

Green finance refers to financial instruments, investments, and strategies that promote environmental sustainability and climate resilience. It encompasses a range of financial activities, including investments in renewable energy, sustainable agriculture, energy efficiency, and more. The primary goal of green finance is to redirect capital flows away from activities that harm the environment and towards those that have a positive impact.

Why Does Green Finance Matter?

Mitigating Climate Change: Green finance plays a pivotal role in mitigating climate change. By channelling funds into projects that reduce greenhouse gas emissions and promote sustainability, it helps combat the root causes of climate change.

Transitioning to a Sustainable Economy: As we move towards a more sustainable economy, green finance provides the necessary resources to support this transition. It enables businesses to adopt eco-friendly practices, develop innovative technologies, and create green jobs.

Risk Mitigation: Climate change poses significant financial risks. Green finance helps businesses and investors identify and manage these risks by encouraging investments in resilient, climate-friendly projects.

Financing Climate-Positive Projects

Now, let’s take a closer look at how green finance is being used to finance climate-positive projects across various sectors.

- Renewable Energy

One of the most prominent areas where green finance is making a difference is in the field of renewable energy. Solar, wind, hydro, and geothermal energy projects are receiving substantial investments from green finance sources. These investments drive the development and expansion of clean energy infrastructure, reducing our reliance on fossil fuels.

- Sustainable Agriculture

Agriculture is a sector with significant environmental implications. Green finance supports sustainable agriculture projects that promote regenerative farming practices, reduce chemical inputs, and protect biodiversity. These initiatives aim to ensure food security while preserving the planet’s ecosystems.

- Energy Efficiency

Improving energy efficiency is crucial for reducing carbon emissions. Green finance enables businesses and homeowners to invest in energy-efficient technologies and retrofits, ultimately lowering energy consumption and greenhouse gas emissions.

- Carbon Offset Projects

To compensate for unavoidable emissions, carbon offset projects receive funding from green finance sources. These projects include reforestation, afforestation, and carbon capture and storage initiatives, which help sequester carbon and counterbalance emissions from various activities.

Challenges and Opportunities

While green finance offers promising solutions to climate change, it faces its own set of challenges. Some of these challenges include:

Standardization: Developing standardized green finance criteria and definitions can be complex, making it challenging to assess the environmental impact of investments accurately.

Scale: Scaling up green finance to the level needed to address climate change requires significant efforts from governments, financial institutions, and investors.

Awareness: Many individuals and businesses are still unaware of the benefits and opportunities associated with green finance.

However, these challenges also present opportunities:

Innovation: Green finance is driving innovation in sustainable technologies, creating new markets and economic opportunities.

Policy Support: Governments worldwide are recognizing the importance of green finance and are implementing policies and incentives to encourage its growth.

Increased Awareness: As awareness of climate change grows, more individuals and businesses are seeking environmentally responsible investment options.

Conclusion

Green finance is more than just a financial trend; it’s a critical tool in the fight against climate change. By channeling capital into climate-positive projects, it has the potential to transform our world into a more sustainable and resilient place.

As consumers and investors become increasingly conscious of the environmental impact of their choices, the demand for green finance options is likely to grow. This, in turn, will encourage more businesses and financial institutions to embrace sustainable practices and contribute to a brighter, greener future for all.

In the face of climate change, green finance offers a glimmer of hope, reminding us that we have the power to shape a more sustainable world through our financial choices. Let’s seize this opportunity and work together to finance climate-positive projects that will benefit both our planet and future generations.