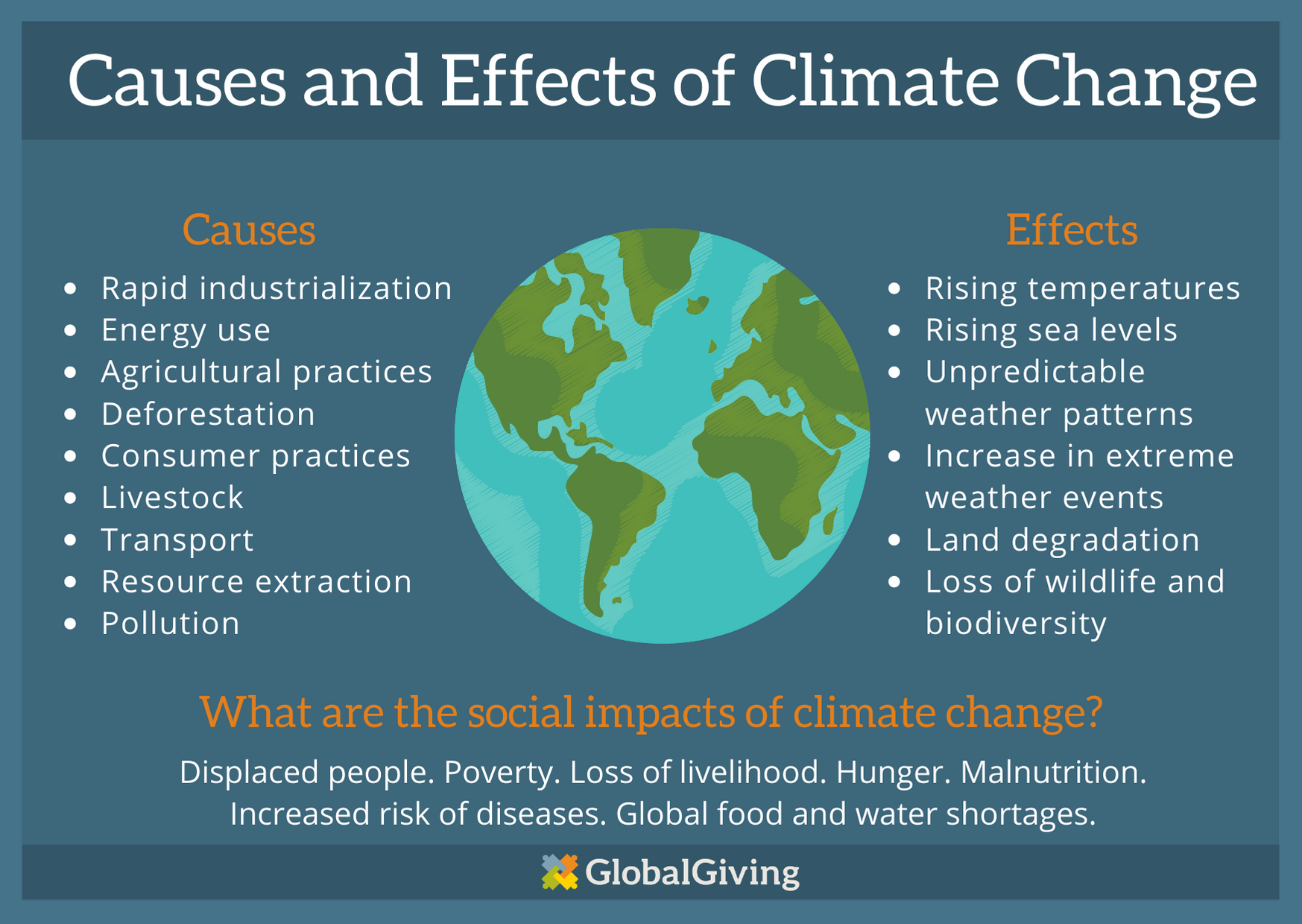

Climate change is no longer a distant threat; it’s a reality that we’re facing today. The impacts of a warming planet are being felt across the globe, from extreme weather events to rising sea levels. While governments, scientists, and individuals are working towards mitigating and adapting to these changes, there’s one industry that’s been thrust into the spotlight: the insurance industry.

The Climate Crisis and Insurance: A Perfect Storm

The insurance industry, by nature, is built upon the concept of managing risk. Insurers assess risks and provide coverage against unexpected events. However, climate change has turned this industry’s risk assessment model on its head.

- Escalating Natural Disasters

Over the past few decades, we’ve witnessed a significant increase in the frequency and severity of natural disasters. From hurricanes and wildfires to floods and droughts, these events are becoming more common due to climate change. As a result, insurance companies are facing skyrocketing claims and payouts, putting immense pressure on their financial stability.

Insurers now have to grapple with the question of how to provide affordable coverage in areas prone to extreme weather events. Some have responded by increasing premiums or excluding certain types of coverage, leaving homeowners and businesses vulnerable.

- Shifting Risk Landscapes

Climate change is not only intensifying existing risks but also creating new ones. For example, rising sea levels are increasing the risk of coastal flooding, while prolonged droughts can lead to water scarcity and agricultural losses. These shifting risk landscapes challenge insurers to reassess their underwriting practices and pricing strategies.

Innovations in risk modeling and data analytics are helping insurance companies better understand and quantify these emerging risks. By leveraging advanced technology, insurers can tailor policies to address specific climate-related threats, providing more accurate and affordable coverage to their customers.

The Role of Insurance in Climate Adaptation

While climate change poses significant challenges to the insurance industry, it also presents opportunities for positive change. Insurers can play a pivotal role in promoting climate adaptation and resilience.

- Encouraging Sustainable Practices

Insurance companies have a vested interest in reducing the frequency and severity of climate-related losses. To achieve this, many insurers are incentivizing their policyholders to adopt sustainable practices. For instance, offering lower premiums to homeowners with energy-efficient homes or rewarding businesses that implement climate-resilient measures.

By encouraging sustainability, insurers not only reduce their own risk exposure but also contribute to broader efforts to combat climate change. This approach aligns with the growing demand from consumers for eco-friendly and socially responsible insurance options.

- Investing in Climate Solutions

The insurance industry manages vast pools of capital, which can be deployed to support climate mitigation and adaptation efforts. Many insurers are increasingly investing in green and sustainable projects, such as renewable energy infrastructure, carbon offset programs, and green bonds.

These investments not only generate financial returns but also contribute to the transition to a low-carbon economy. Insurers can act as powerful catalysts for positive environmental change by directing their resources towards projects that reduce greenhouse gas emissions and enhance resilience.

Conclusion: A Climate-Resilient Future

The insurance industry is at a crossroads, facing both unprecedented challenges and opportunities in the era of climate change. While the escalating cost of natural disasters threatens the financial stability of insurers, proactive measures and innovations can help navigate this uncertain terrain.

As individuals, businesses, and governments grapple with the complex and evolving impacts of climate change, insurance companies must continue to adapt. By promoting sustainability, investing in climate solutions, and reimagining risk assessment, the insurance industry can be a force for positive change in a world that desperately needs it.

In this climate-resilient future, insurers can provide the protection and support needed to build a more sustainable and secure world for us all. It’s not just about insuring against risk; it’s about insuring our collective future.