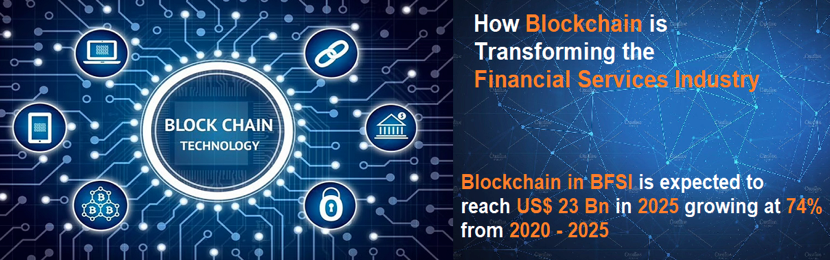

The finance industry is undergoing a significant transformation as a result of advances in technology, and blockchain is one of the most promising. Blockchain technology has the potential to disrupt traditional financial systems by providing a more secure, transparent, and efficient way of conducting transactions. In this post, we’ll explore how blockchain is transforming the finance industry and what it means for businesses and consumers.

What is Blockchain?

Blockchain is a decentralized ledger that records transactions in a secure and transparent way. Each block in the chain contains a cryptographic hash of the previous block, making it virtually impossible to alter previous transactions. The decentralized nature of blockchain means that there is no need for intermediaries, such as banks or financial institutions, to verify transactions.

How is Blockchain Transforming the Finance Industry?

Secure Transactions

Blockchain technology provides a more secure way of conducting transactions compared to traditional financial systems. The decentralized nature of blockchain eliminates the need for intermediaries, reducing the risk of fraud and hacking. Each transaction is recorded in a secure and transparent way, making it virtually impossible to alter or manipulate.

Faster Settlement Times

Traditional financial systems can take several days or even weeks to settle transactions. Blockchain technology can facilitate almost instantaneous settlement times, reducing the time and cost of transactions. This is particularly beneficial for cross-border transactions, which can be complex and time-consuming.

Lower Transaction Fees

Traditional financial systems charge significant fees for transactions, particularly for cross-border transactions. Blockchain technology can eliminate the need for intermediaries, reducing transaction fees and making transactions more affordable for businesses and consumers.

Improved Transparency

Blockchain technology provides a transparent way of recording transactions, making it easier for businesses and consumers to track and verify transactions. This can help to reduce the risk of fraud and corruption and increase trust in the financial system.

Enhanced Data Security

The decentralized nature of blockchain provides enhanced data security, reducing the risk of data breaches and hacking. Each transaction is verified and recorded in a secure and transparent way, making it virtually impossible to alter or manipulate.

Real-World Examples of Blockchain in Finance

Cross-Border Payments

Blockchain technology is being used to facilitate cross-border payments, providing a more secure, transparent, and efficient way of conducting transactions. Ripple is one of the most well-known blockchain-based payment systems, which has partnered with various banks and financial institutions to provide faster and more affordable cross-border payments.

Digital Identity Verification

Blockchain technology can be used to create a secure and transparent digital identity verification system. This can help to reduce the risk of identity theft and fraud, making it easier for businesses to verify the identity of their customers and comply with regulations.

Smart Contracts

Blockchain technology can be used to create smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. Smart contracts can automate complex financial processes, reducing the time and cost of transactions.

Asset Management

Blockchain technology can be used to facilitate asset management, providing a more efficient and transparent way of managing assets. Blockchain-based asset management systems can reduce the risk of fraud and improve transparency and accountability.

Conclusion

Blockchain technology has the potential to transform the finance industry by providing a more secure, transparent, and efficient way of conducting transactions. While there are still challenges to be addressed, such as scalability and regulation, the adoption of blockchain in finance is expected to continue to grow. Businesses that embrace blockchain technology stand to gain a competitive advantage by improving their