Building a personal finance budget may seem intimidating, but it doesn’t have to be. In fact, creating a budget is one of the most important things you can do for your finances. By tracking your income and expenses, you can identify areas where you can cut back on spending and allocate more money toward savings and debt payments. In this blog post, we’ll break down the steps to help you create a budget that works for your unique financial situation.

Step 1: Identify Your Income

The first step in building a personal finance budget is identifying your income. This includes any money you earn from your job, as well as any additional sources of income such as rental properties or side hustles. Make sure to include your after-tax income, as this is the amount you have available to allocate toward expenses and savings.

Step 2: Track Your Expenses

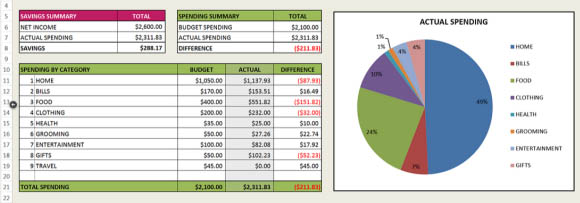

The next step is to track your expenses. This includes everything from your monthly rent or mortgage payment to your daily coffee habit. Make a list of all your expenses and categorize them into fixed expenses (such as rent or car payments) and variable expenses (such as groceries or entertainment). Be sure to include annual expenses like insurance premiums or car registrations, and divide them by 12 to get the monthly amount.

Step 3: Set Your Financial Goals

The third step is to set your financial goals. These can include short-term goals like paying off credit card debt or saving for a vacation, as well as long-term goals like saving for retirement or buying a house. Setting specific, measurable goals can help you stay motivated and on track.

Step 4: Allocate Your Income

Now that you know your income, expenses, and financial goals, it’s time to allocate your income. Start by subtracting your fixed expenses from your income, and then allocate money toward your variable expenses and financial goals. If you find that you don’t have enough money to cover all your expenses and goals, you may need to make some adjustments. Look for areas where you can cut back on spending, such as dining out or subscription services.

Step 5: Monitor Your Budget

The final step is to monitor your budget regularly. Review your budget on a monthly basis and compare your actual spending to your budgeted amounts. If you find that you’re overspending in certain categories, adjust your budget accordingly. Similarly, if you find that you’re consistently underspending in certain categories, you may want to consider adjusting your budget to allocate more money toward your financial goals.

Conclusion

Building a personal finance budget may seem overwhelming at first, but by following these simple steps, you can create a budget that works for your unique financial situation. Remember to track your income and expenses, set specific financial goals, allocate your income, and monitor your budget regularly. With a little effort and discipline, you can take control of your finances and achieve your financial goals.