User experience (UX) design is a critical factor in the success of any product or service, and the financial services industry is no exception. In today’s digital age, where customers have a multitude of choices at their fingertips, providing an exceptional user experience can set a financial institution apart from its competitors. In this blog post, we will explore the importance of UX design in the world of financial services and delve into key strategies and principles that can be applied to create a seamless and user-friendly financial experience.

The Significance of UX Design in Financial Services

The financial services industry is inherently complex, dealing with various financial products, regulations, and customer expectations. In such an intricate landscape, the role of UX design becomes even more crucial. Here are some key reasons why UX design is of paramount importance in financial services:

- Building Trust and Credibility

Trust is the cornerstone of any successful financial institution. Customers need to have confidence that their money and personal information are secure. A well-designed user interface can instill trust by providing a sense of professionalism and reliability. Clear navigation, strong data security measures, and transparent communication can all contribute to building trust with users. - Simplifying Complex Processes

Financial transactions can be daunting for many people, especially those not well-versed in finance. UX designers have the task of simplifying these processes to make them accessible to a broader audience. Whether it’s opening an account, applying for a loan, or managing investments, the user journey should be intuitive and straightforward. - Enhancing Accessibility

Financial services should be accessible to everyone, regardless of their age, background, or abilities. UX designers must consider accessibility standards and ensure that digital platforms are inclusive. This includes features like text-to-speech compatibility for visually impaired users and easy-to-read fonts and contrast for those with reading difficulties. - Improving Customer Engagement

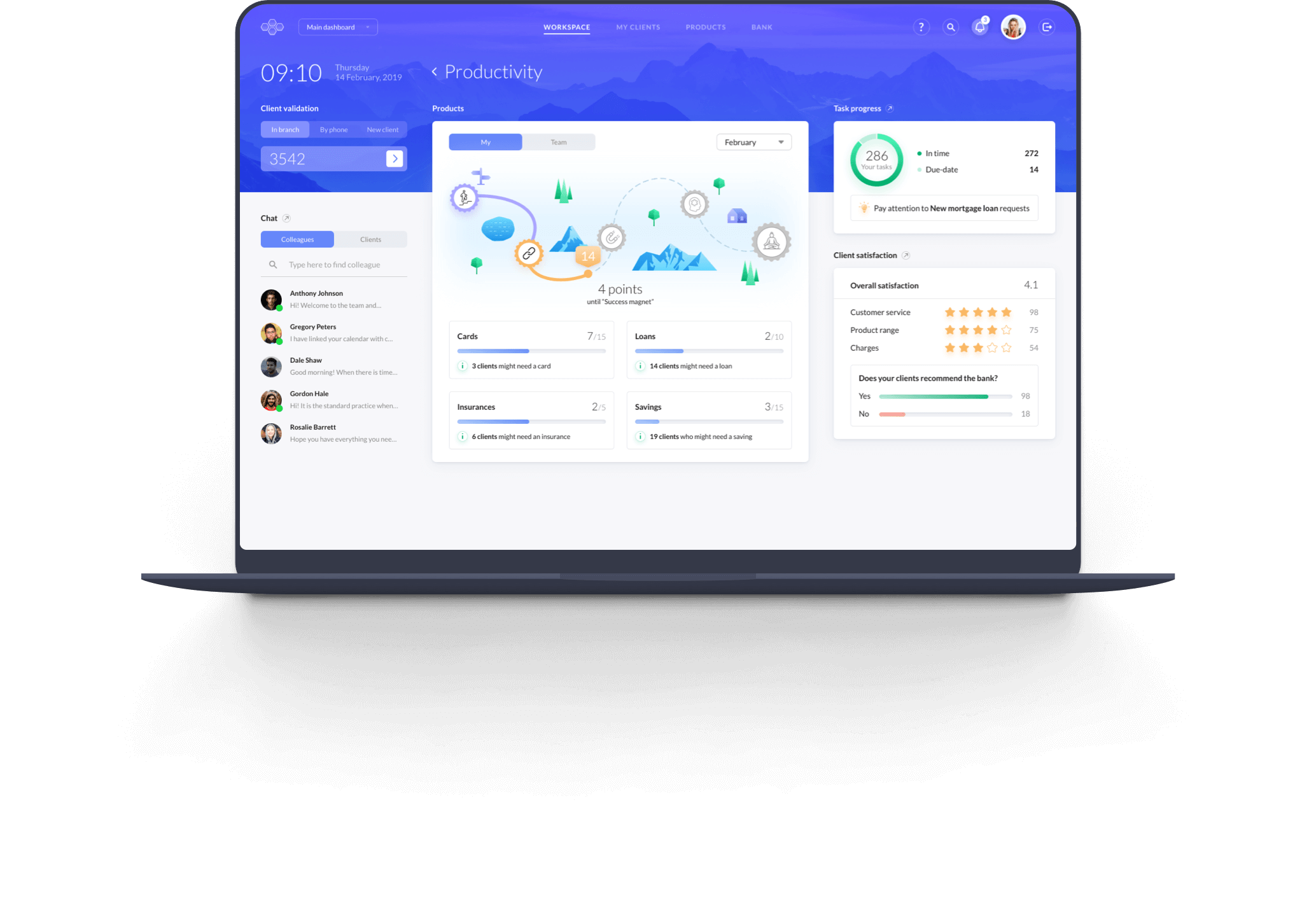

User experience design extends beyond aesthetics and functionality; it’s also about engagement. Financial institutions can leverage UX design to create personalized experiences that keep customers engaged and informed. This can involve offering financial planning tools, educational resources, and personalized recommendations based on user behavior.

Key UX Design Principles for Financial Services

Now that we’ve established the significance of UX design in financial services, let’s delve into some essential principles that can guide the creation of user-friendly financial products and services.

- User-Centered Design

At the heart of UX design is a focus on the user. Designers must conduct thorough user research to understand customer needs, preferences, and pain points. By empathizing with users, financial institutions can create solutions that genuinely address their concerns and deliver value. - Consistency Across Platforms

Many customers interact with financial services through various channels, such as mobile apps, websites, and in-person visits. It’s crucial to maintain consistency in design elements, branding, and messaging across all these touchpoints. This consistency reinforces the institution’s identity and helps users feel comfortable and familiar with the services. - Security and Data Privacy

In the realm of finance, security is non-negotiable. UX designers must work closely with cybersecurity experts to ensure that user data is protected at all times. Transparent communication about security measures and data privacy policies can also reassure users and build trust. - Intuitive Information Architecture

A well-structured information architecture is the backbone of a user-friendly financial platform. Users should be able to find the information they need quickly and easily. Clear navigation menus, intuitive labeling, and logical content organization are essential components of an intuitive information architecture.

Case Studies: UX Success Stories in Financial Services

Let’s take a look at a few real-world examples of financial institutions that have excelled in UX design and reaped the rewards in terms of customer satisfaction and loyalty.

- Chime

Chime is a neobank that has gained popularity for its user-friendly app and website. They offer features like early direct deposit, no hidden fees, and real-time transaction notifications. Chime’s minimalist design and straightforward language make managing finances a breeze for users. - Robinhood

Robinhood revolutionized the world of stock trading with its mobile app. Its clean and intuitive interface allows users to buy and sell stocks with ease. The app’s success is a testament to the power of user-centered design in the world of investments. - Mint

Mint, a personal finance management tool, provides users with a comprehensive overview of their financial health. It aggregates data from various financial accounts and presents it in a visually appealing and easy-to-understand format. Mint’s success lies in its ability to simplify complex financial data.

The Future of UX in Financial Services

As technology continues to advance, so too will the possibilities for UX design in financial services. Here are some trends and areas to watch in the coming years:

- AI-Powered Personalization

Artificial intelligence and machine learning will enable financial institutions to offer highly personalized experiences. AI algorithms can analyze user data to provide tailored financial advice, product recommendations, and alerts. - Voice and Conversational Interfaces

Voice assistants like Siri and Alexa are becoming increasingly integrated into financial services. Users can check balances, transfer funds, or even get investment advice using voice commands. Conversational interfaces will continue to evolve to meet user needs. - Blockchain and Cryptocurrency UX

As blockchain technology and cryptocurrencies gain traction, UX designers will play a crucial role in simplifying the user experience. Making blockchain transactions and managing digital assets user-friendly will be a significant challenge and opportunity.

In conclusion, UX design is not just a trend but a necessity in the ever-changing landscape of financial services. Financial institutions that prioritize user-centered design, consistency, security, and intuitive information architecture will stand out and thrive in a competitive market. By continually adapting to emerging technologies and user preferences, the future of UX in financial services holds the promise of even more accessible, secure, and engaging financial experiences for all.